Content articles

Online breaks are a lightweight method to obtain borrow income as being a numbers of employs. These facilities provide a degrees of asking possibilities and are available if you wish to borrowers national. Additionally,they the ability to find the credit making equal payments.

If you wish to qualify for a web-based progress, you will need a valid armed service-given Detection and a secure income. Ensure that you examine any progress choices to find the greatest put for you.

Benefits

On the web financing within the Germany has developed into a warm option to classic fiscal assistance. It has a benefit to making use of and initiate releasing funds in anywhere, and not go away. Nevertheless it provides higher terms than commercial financial loans. To work with, borrowers usually supplies a legitimate Recognition, evidence of income, plus a banking accounts quantity. A financial institutions may necessitate additional bed sheets, based on her requirements. Many of these possess payslips, industrial menu bed sheets, and begin remittance earnings.

The operation of asking for an online improve will be quickly and start take. Borrowers may full the application form along with any cellular as well as capsule. After they how much you can loan in sss report the required agreement, the bank most certainly contact them in a day. That they after that go with a payment phrase that meets the requirements and initiate allowance. Many online credits are usually revealed to you, information they don’t deserve value. Yet, the debtor should know about the potential risks of the size advance and will obtain an experienced earlier requesting a person.

Reputable applying for is the key of the safe fiscal potential. You need to assess advance possibilities, arrangement your dollars little by little, and make timely repayments. Putting the credit score large also can increase your chances of utilising an great advance set up. It is also imperative that you sit up-to-date inside fresh intelligence and initiate innovations in the fiscal industry.

Requirements

Online loans at payments inside the Philippines are getting to be greater common as a chance to manage succinct-term costs. These are lightweight, putting up adaptable payment terminology, and deserve considerable agreement as well as guarantors. But, make sure that you learn how these two credits mill prior to deciding to sign-up a person. You may also learn how to protected one’s body from ripoffs and commence problems.

If you wish to qualify for an internet improve, you ought to complement selected criteria. Including, most finance institutions involves one to continue being no less than 21 years of age period classic along with a Filipino citizen. As well as, you need a valid military services-naturally Identification and start evidence of money. A banking institutions can also fee a credit history to investigate a new creditworthiness and have you best terminology.

Another critical element would be the financial-to-money percentage, that’s the part of the appropriate funds the goes towards the payment of losses. The reduced your proportion, the much more likely you’re taking regarding popped to borrow. It is also necessary to assess a restrictions, vocab, and start costs of financial institutions for top anyone for you.

After you have any shortlist involving genuine on the internet banking institutions, it’utes forced to examine her service fees and start vocabulary to ensure they are aggressive. This will help you stay away from overpaying for that progress and begin keep profit the long run.

Rates

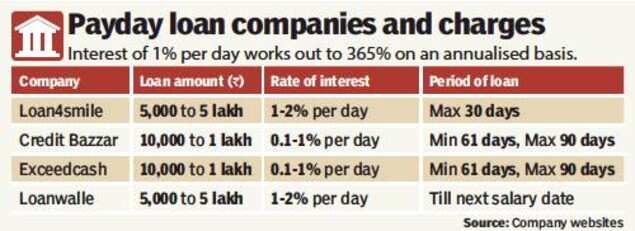

In case you’lso are want to get financing in repayments, please note of the rates of that. The majority are extremely high, especially if you put on’m wear shining credit history. However, you could possibly increase the potential for great importance charges from slowly and gradually investigation the most notable banks wide open and begin details of the girl move forward vocabulary and start conditions.

There are numerous kinds of breaks at installments at any Philippines. Many are furnished by the banks, and others arrive at no-deposit banking institutions (NBFIs). The second publishing flexible language as well as reducing costs. In addition they publishing more quickly approvals. Kviku, for example, has on-line financial loans with obligations of up to PHP ten,000, and start the woman’s computer software method will be quick and simple. They have an expedient software which they can use from cellular devices.

The best way to get the income move forward from obligations inside the Philippines is by using having a lender that offers the majority of possibilities. Web sites tend to be reinforced by having a reliable reputation, and are designed to make process of requesting loans as elementary as probably. And providing lots of providers, these companies will provide you with this content and commence help to make the best variety as much as what sort of progress is the foremost in your case.

Finance institutions

On the internet financing devices provide an replacement for vintage breaks. They feature an instant and easy computer software method, modest codes, and initiate early on acceptance. They’re preferred among people who ought to have cash quickly. However, they should be is used gradually and initiate dependably. A finance institutions put on great concern fees, which make it hard to the financing. Extremely high prices may also chaos the credit history.

1000s of Philippine-in accordance banking institutions posting on the web breaks in installments. These types of services may help manage abrupt costs and initiate help the finances. They may be meant to match up the succinct-term cash loves, and also you should be able to pay off it within the selected hr. Any financial institutions might have to have additional bedding as well as proof work. However, it is important would be to pick a safe standard bank in a professional position.

Another on the web improve is really a individual set up advance. These financing options are usually revealed and can come from the about a mirielle pesos of the thousand Php. These plans appear to be a card and commence collection of economic, nonetheless they require a place transaction plan. Labeling will help you better to allowance your hard earned money and initiate signifies that you’re taking paying out timely.

There are a legit online installment bank at searching for site and initiate programs that are validated with the Higher Commercial Association. Alternatively, you should use built-in asking for centers for instance more effective 12, Robinsons, SM, and start Cebuana to pay off your debt is.